Is the taxpayers phone number an optional entry or does it have to be entered on the Form 4506-C. The customer file number cannot contain an SSN ITIN or EIN.

Https New Content Mortgageinsurance Genworth Com Documents Training Course Best 20practices 20for 20completing 20irs 20form 204506t 20 20feb 202018 Pdf

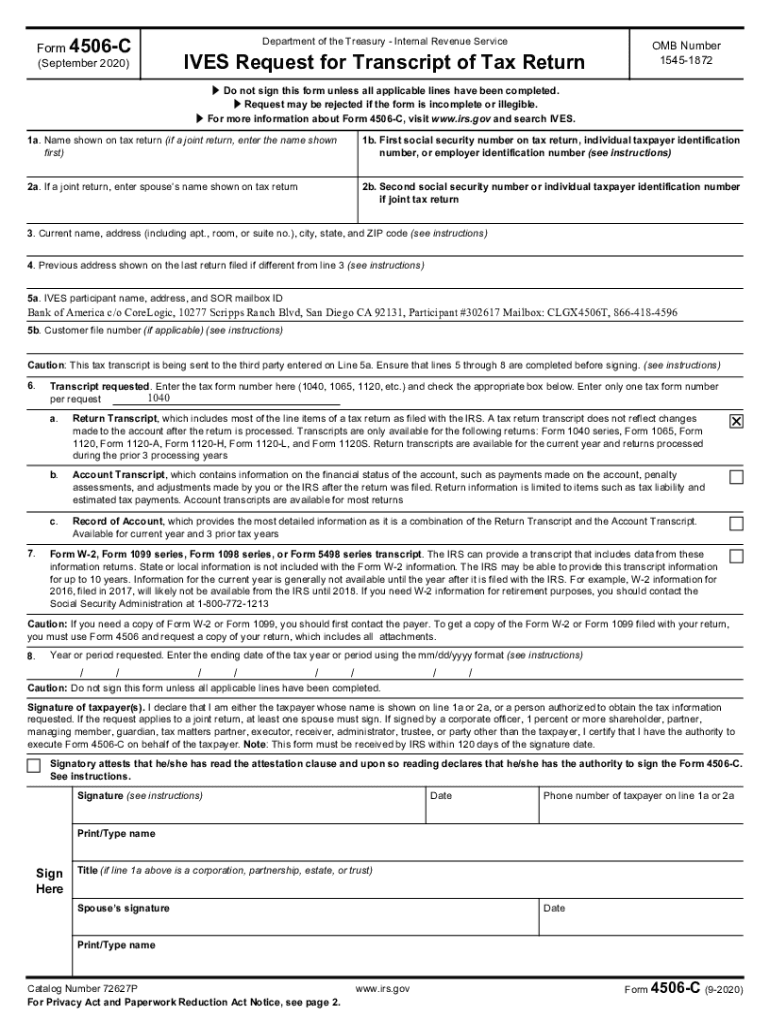

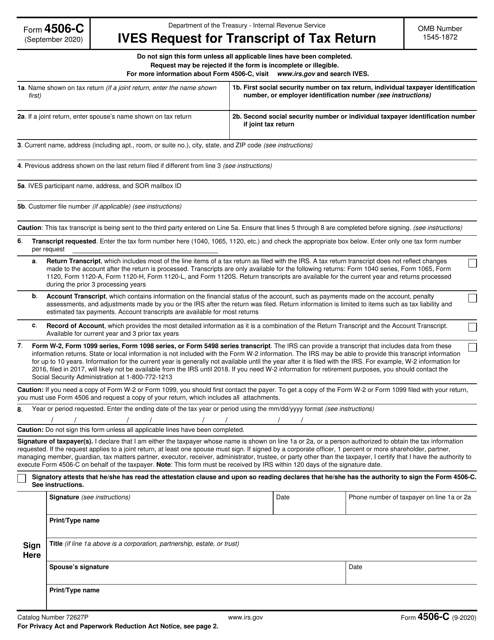

IRS Form 4506-C Review and Validate to Avoid Processing Delays The following steps will help avoid the most common 4506-C processing errors.

Business 4506-c. IVES Request for Transcript of Tax IRS form is 1 page long and contains. Once completed you can sign your fillable form or send for signing. Enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript.

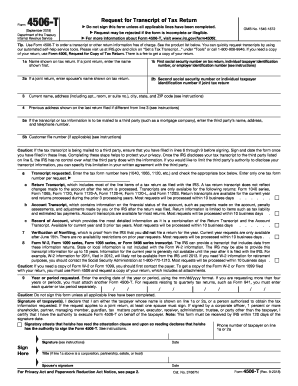

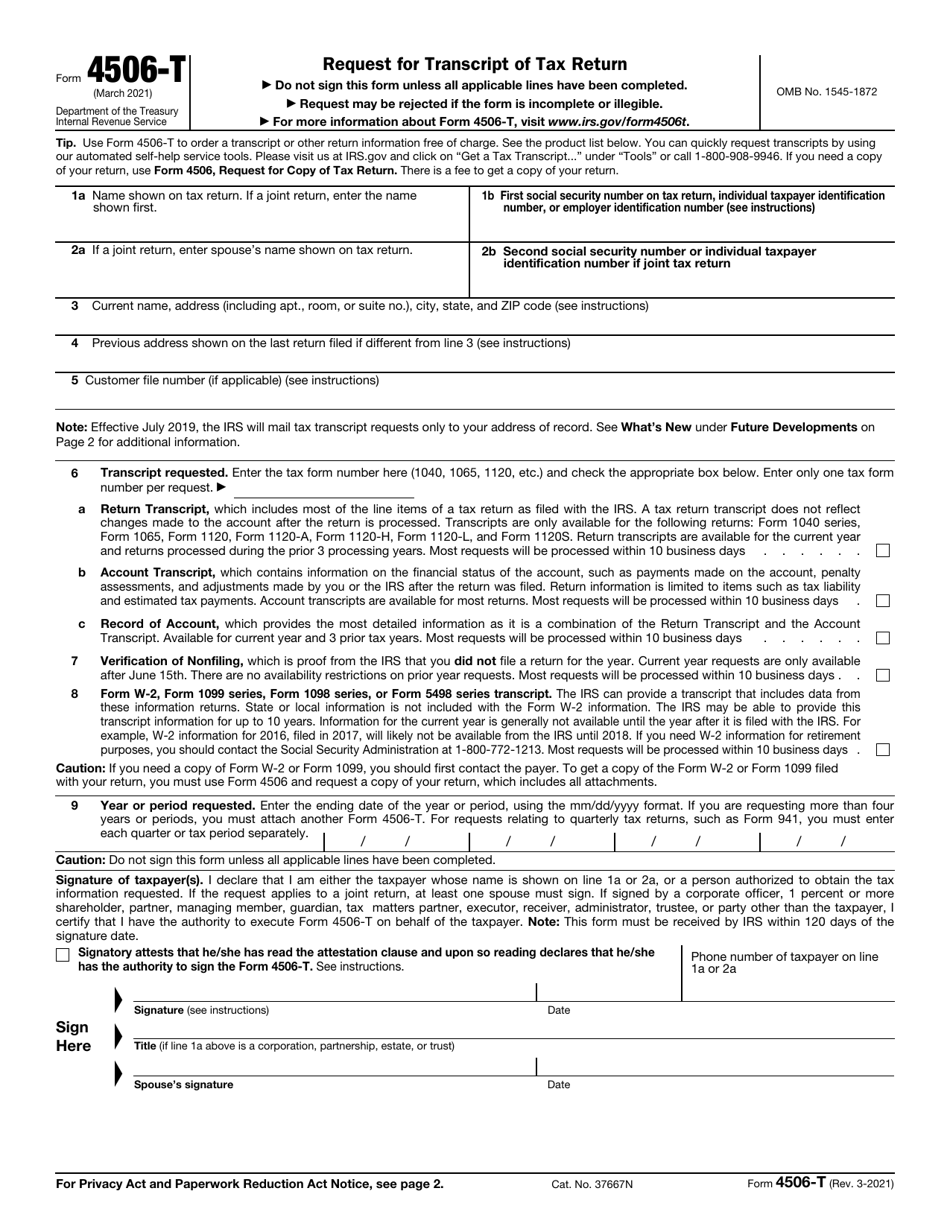

Request for Transcript of Tax Return. Revision of a currently approved collection. Completion of this line is not required.

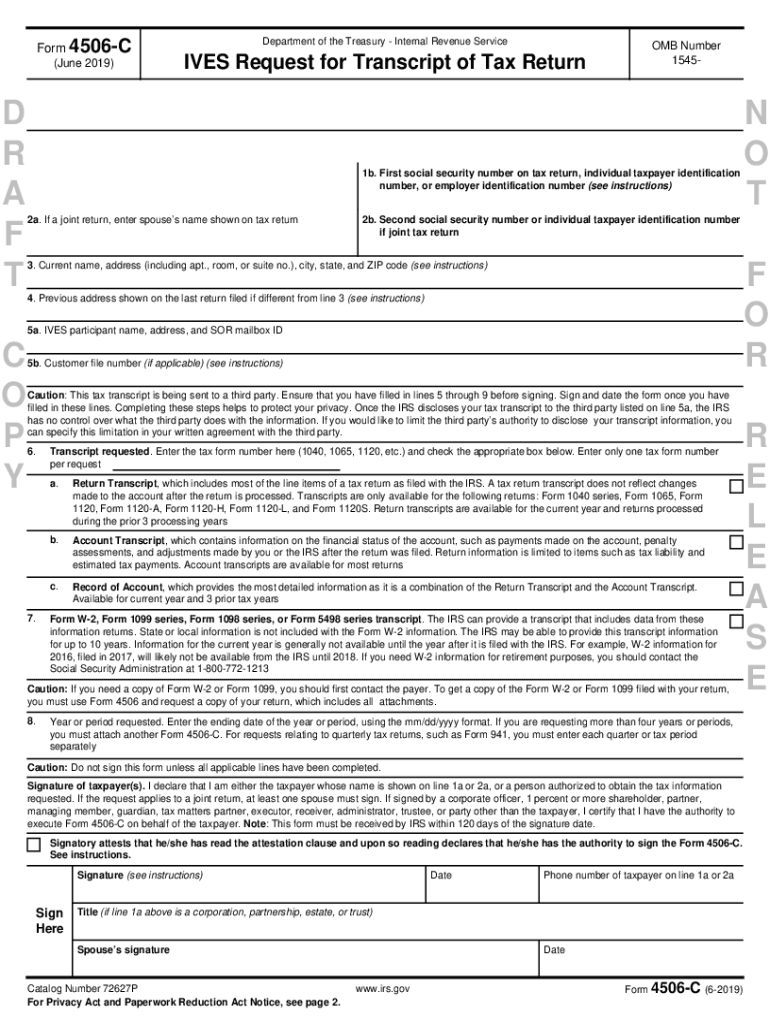

Can I fax batches that include. IVES Request for Transcript of Tax Return. The IRS recently announced that it will be replacing the form 4506-T IRS Tax Transcript Request with a new form the 4506-C.

If you use an SSN name or combination of. Responsible Party Business with Form 4506-C. Responsible Party Business with Form 4506-C.

Form 4506-T requires only a few lines of general information beginning with name address and Social Security number. No the acceptable signature business titles have not changed with the release of the Form 4506-C. Completion of this line is not required.

Business or other for-profit organizations individuals or households farms and Federal state local or tribal governments. Completion of this line is not required. Enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript.

This would typically take up to 60-days for the requestor to receive because they were printed out and mailsnail-mail to the requestor. IVES Request for Transcript of Tax IRS On average this form takes 8 minutes to complete. 24072019 The new 4506-C will permit the cleared and vetted IVES clients to request tax return information on the behalf of the authorizing taxpayer.

Fannie Mae requires lenders to have each borrower whose income regardless of income source is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Responsible Party Business with Form 4506-C. Enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript.

This means mortgage lenders will need to have borrowers sign Form 4506-C to give permission for obtaining their tax transcripts. Business titles change for Form 4506-C. Lenders must fill in as the recipient of the tax documents either its name or the name of the servicer if servicing will be transferred within 120 days of.

Enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript. The information on the 4506-C Version September 2020 must match the borrowers most recently filed tax returns EXACTLY. Employers engaged in a trade or business who pay compensation.

If you use an SSN name or combination of. 20042021 Heres what we know about the 4506 4506 T and 4506 C. Instructions for Form 4506-A Request for Public Inspection or Copy of Exempt or Political Organization IRS Form.

The Internal Revenue Service IRS recently released a new version of Form 4506 as Form 4506-C IVES Request for Transcript of Tax Return version September 2020. Responsible Party Business with Form 4506-C. The originator is responsible for completing and returning an accurate 4506-C form.

Yesterday Fannie Mae also acknowledged the revised IRS form and encouraged lenders to begin using the form immediately due to. The customer file number cannot contain an SSN ITIN or EIN. 4506 Initially implemented in 1988 and used to retrieve full copies of tax returns from the IRS.

18112015 However if the business is an LLC or corporation or is required to file taxes separately then one Form 4506-T is needed for each type of income. 12152020 105042 AM. The customer file number cannot contain an SSN ITIN or EIN.

The customer file number cannot contain an SSN ITIN or EIN. The IRS will no longer accept the 4506-T form as of March 1 2021. A signed Form 4506-C is required to be obtained for each borrower at or before closing for all income types used in the underwriting process personal or business QC When a loan is selected for QC review the lender must submit a signed Form 4506-C to the IRS to obtain a tax.

02062021 One IRS Form 4506-C will be required to obtain a transcript of the personal 1040 returns and another will be required for the business returns Form 1065 Form 1120 Form 1120A etc. Sloane La Scalza Created Date. If you use an SSN name or combination of.

Effective March 1 2021 only the new IRS Form 4506-C will be accepted through the Income Verification Express Service IVES to provide tax transcripts to third parties. Employers Quarterly Federal Tax Return. If you use an SSN name or combination of.

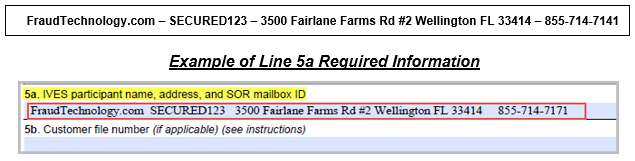

Completion of this line is not required. Previously the IRS posted an updated Form 4506-T version June 2019 which removed Line 5a which covers mailing tax transcripts to third parties and replaced the Caution statement after Line 5 with the following. 4506T This was the next iteration and issued.

Form 4506-C 9-2020 Author. No the phone number is not required for the Form 4506-C to be processed. 02062021 The IRS IVES Request for Transcript of Tax Return IRS Form 4506-C gives the lender permission from the borrower to obtain tax transcripts from the IRS.

All forms are printable and downloadable. 18122020 New IRS Form 4506C 2021.

Irs Transcript Of Tax Return Fill Out And Sign Printable Pdf Template Signnow

4506 C Fillable Form Fill And Sign Printable Template Online Us Legal Forms

Https Www Michigan Gov Documents Mgcb 4506t Cover 296413 7 Pdf

4506 C Pdf Fill And Sign Printable Template Online Us Legal Forms

Irs Form 4506 C Download Fillable Pdf Or Fill Online Ives Request For Transcript Of Tax Return Templateroller

Irs Form 4506 T Download Fillable Pdf Or Fill Online Request For Transcript Of Tax Return Templateroller

New Irs Form 4506 C Homebridge Wholesale

0 comments:

Post a Comment